The Gift That Gives Back

Thank you for considering a Franciscan Gift Annuity with the Conventual Franciscan Friars of the Province of Our Lady of Consolation.

Higher Franciscan Gift Annuity Payouts as of January 1, 2024, up to 10.1%!

You will receive higher payments for life — and they’ll stay that way, no matter the markets.

Fill out the form or call us today to get your confidential proposal.

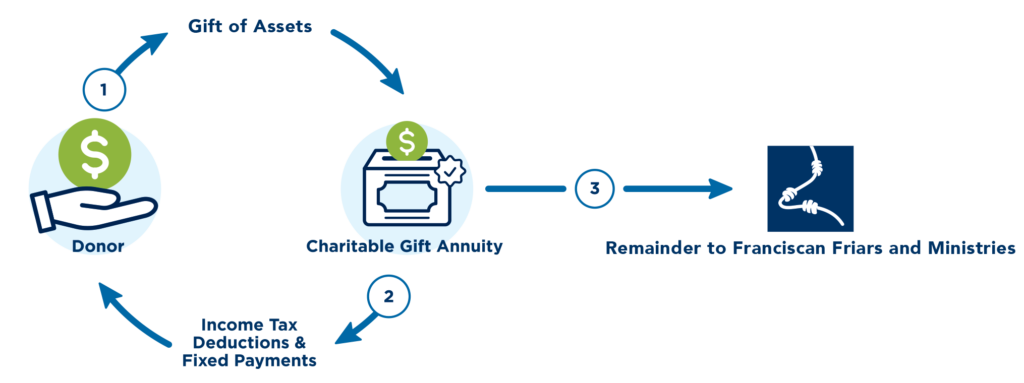

A Franciscan Charitable Gift Annuity is a contract between you and the friars, and through careful planning, you can provide yourself and a loved one an attractive income for the rest of your lives. You are assured with the knowledge that you and your loved one will benefit and your legacy of supporting the friars continues when the remaining gift transfers to the friars for ministry.

How It Works

A legacy gift to the friars and payments for life to you.

Benefits of a Franciscan Gift Annuity

- Fixed income for life

- An immediate income tax deduction for a portion of the value of the assets used to fund the gift

- A portion of each payment to the annuitant(s) is tax free until the annuitant(s) reach life expectancy, at which time payments are taxed as ordinary income

- No capital gain taxes at the time the gift is made

- Reduction or elimination of estate taxes

- Upon the death of the annuitant(s), the remaining gift transfers to the friars for ministry

Franciscan Gift Annuity Requirements

- Donor is 60 years or older

- Minimum $5000 donation

- Can accept gifts of cash, appreciated securities and common stock

A real world example…

Frances and Jim Block have watched interest rates fluctuate for years. They have not been satisfied with their current money market fund earnings and will appreciate a way to receive the higher rate of return they enjoyed in prior years. They do not want to increase their market risk by investing in securities that fluctuate in value. Frances and Jim have enjoyed volunteering their time and have developed a deeper understanding of how the friars minister to God’s people.

| Money Market | |

| Value: Interest Rate: Annual Return: |

$100,000 3.0% $3,000 |

They wanted to invest in the friars and asked for information about a Franciscan Gift Annuity from the Mission Advancement Offices.

Frances and Jim are happy with the increased income and the tax savings, and they are really excited about what their gift will mean to the care of the Senior Friars.

* Based on the current ACGA suggested rates effective 01/01/2023.

| Jim and Frances Block’s Franciscan Gift Annuity | ||

| Annuitants Ages | 74 and 76 | |

| Cash Donated | $100,000 | |

| Payout Rate* | 6.2% | |

| Charitable Deduction | $39,052 | |

| Annual Payment | $6,200 | |

| $3,806 – Tax-Free Portion | ||

| $2,393 – Ordinary Income | ||

| After 16 years, the entire annuity becomes ordinary income. | ||

| Friars will receive remaining principal when annuity ends. | ||

See your personalized proposal.

We make setting up a Gift Annuity easy. Creating your legacy and helping the friars is just one click away.

Please Note: The friars are unable to issue gift annuities to residents of certain states because of state registration requirements.

Other Life Income Plans

As soon as a gift is received and matched to a donor, the Mission Advancement Office sends an acknowledgment letter stating the nature of the gift, the gift valuation date, and the gift valuation amount and a clarification statement indicating no goods or services were exchanged for the gift.

The Province of Our Lady of Consolation is a tax-exempt 501(c)(3) organization (EIN # 35-6019627) and does not provide tax, legal, or financial advice. Any document or information shared by our staff is intended to be educational. We strongly encourage donors to seek counsel from their own legal and financial advisors.