Thank you for considering a gift of stock or other assets to the Conventual Franciscan Friars of the Province of Our Lady of Consolation.

Thank you for considering a gift of appreciated assets such as stocks, bonds and mutual funds; plus, real estate, art and collectibles as a source of support for the ministries of the Conventual Franciscan Friars. Donations of appreciated assets provide favorable tax treatment without incurring a capital gains tax upon the sale of the asset. At the same time, you are eligible to deduct the full fair-market value of the asset you donated from your income taxes, up to the overall amount allowed by the IRS. Members of the Mission Advancement Staff will work with you and your financial advisor to properly administer your gift to the friars.

We Love to Help

Need help? Contact us at (812) 923-5250,

or it is easy as pushing a button.

Stock/Securities Gift to the Friars

Fields marked with an * are required

A friendly Mission Advancement representative will contact you, if you fill out the form below it will help us get back you.

How It Works

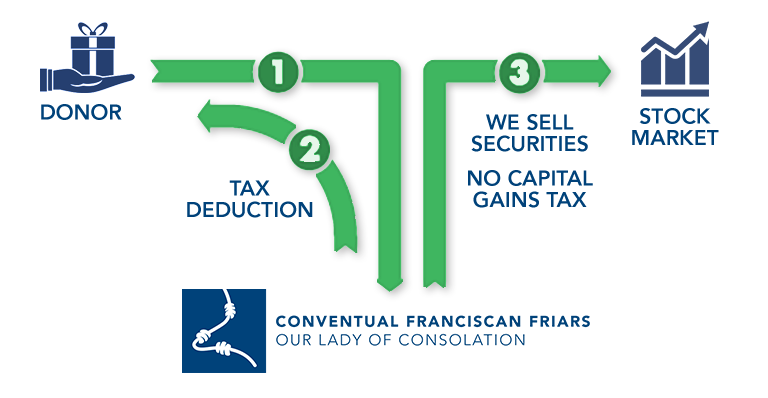

Avoiding Capital Gains Tax. It is as easy as…. 1, 2, 3

1. Give appreciated assets

2. File your taxes

3. Avoid Capital Gains

Gifts of assets which have increased in value since their purchase are particularly attractive under our current tax laws. Consider that:

- Sales of stocks, bonds, mutual funds and real property that have appreciated in value generate a taxable capital gain.

- Gifts of those same appreciated assets to the friars are deductible at their full fair-market value if they have been held longer than twelve months.

- The fair-market value of the asset(s) can be deducted up to thirty percent (30%) of the donor’s adjusted gross income.

- Excess deductions can be carried forward into as many as five additional tax years.

To Make a Gift

To notify the friars of a gift of appreciated assets or if you have any questions, please contact us at (812) 923-5250 or by using the contact us button here. You can also directly download the form letter here to provide to your financial institution. This letter includes all of the instructions needed to facilitate your generous gift to the friars, starting with your name listed on the form.

Stock/Securities Gift to the Friars

Fields marked with an * are required

A friendly Mission Advancement representative will contact you, if you fill out the form below it will help us get back you.

A Real World Example…

Rita Smith was planning to make a gift to the friars and by donating stock she owned, the amount of her gift was larger than she had originally planned. After talking to her financial advisor, Rita learned that if she gave the friars 20 shares of Amazon that she had owned for 13 months, the sale of those shares by the friars would yield enough cash to repair the chapel roof at the friary she loved to visit. By donating the stocks, Rita eliminated the capital gains tax she would have incurred if she has sold the stock herself and then donated the sale proceeds.

In order to promptly and accurately credit a gift of appreciated assets to the appropriate donor, it is essential that the transfer instructions include the donor’s name and address. Without this information, we are occasionally unable to send you the correct charitable gift receipt.

Other Appreciated Assets

As soon as a gift is received and matched to a donor, the Mission Advancement Office sends an acknowledgment letter stating the nature of the gift, the gift valuation date, and the gift valuation amount and a clarification statement indicating no goods or services were exchanged for the gift.

The Province of Our Lady of Consolation, is a tax exempt 501(c)(3) organization (EIN # 35-6019627) and does not provide tax, legal, or financial advice. Any document or information shared by our staff is intended to be educational. We strongly encourage donors to seek counsel from their own legal and financial advisors.